Key points:

- Bitcoin stages a late comeback into the weekly close as price approaches important liquidation zones.

- Traders and analysts emphasize various key price points to reclaim next.

- Volatility is expected based on large-volume trading behavior, analysis reports.

Bitcoin surged above $119,000 Sunday as bulls extended a rebound from two-week lows.

Bitcoin price volatility returns into weekly close

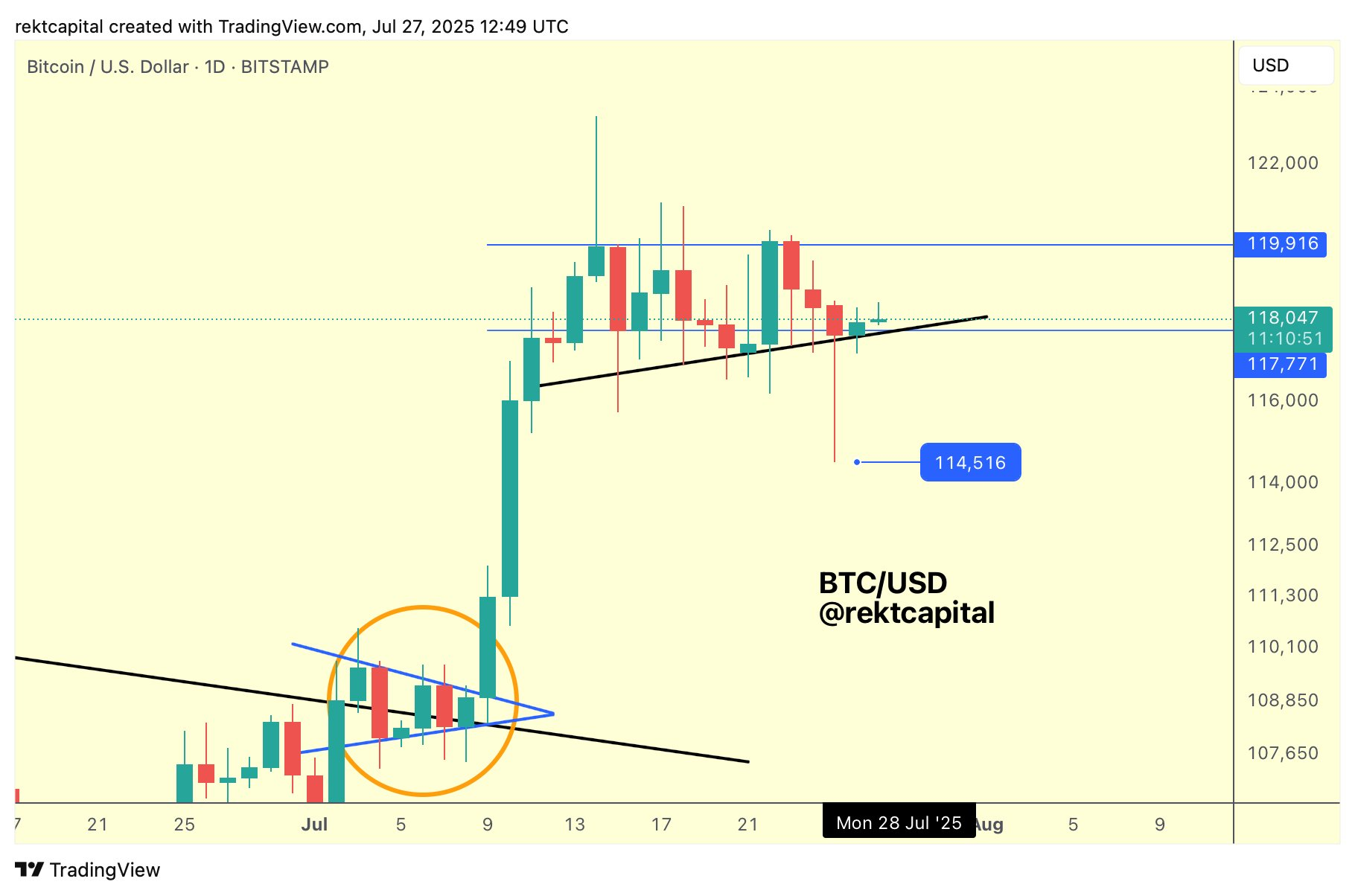

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD approaching a key reclaim area.

Now attempting a daily close above its 10-day simple moving average, the pair held onto a rebound from near $114,500 as the market forgot one of the largest-ever BTC sales.

The uptick came amid news that the US and China had agreed to further delay the introduction of reciprocal trade tariffs.

Market participants thus focused on the key levels to look for going into the new week.

“$BTC needs to break above $119.5K for a big move. If that doesn't happen, this consolidation will continue,” crypto investor and entrepreneur Ted Pillows summarized in a post on X.

“I think BTC could break above this level next month which will start the next leg up.”

Popular trader and analyst Rekt Capital eyed a slightly higher range ceiling just below the $120,000 mark.

“Bitcoin has Daily Closed above the blue Range Low, kickstarting a break back into the very briefly lost Range,” he told X followers alongside a print of the daily BTC/USD chart.

“Any dips into the Range Low (confluent with the new Higher Low) would be a retest attempt to confirm the reclaim.”